Spanish settlement continued to ebb and flow. The English began to settle the area in the 18th and 19th centuries, but the first permanent white settlement wasn't established until about 1800 when Pedro Fornells arrived on Key Biscayne.

The Seminole Wars devastated the native populations, leaving the land free for European and Bahamian settlers. The Village of Miami was charted on the south bank of the river in the early 1840s, and in 1844 Miami became the county seat. New settlers arrived, including the Brickells; still famous as a Miami neighborhood name today. New settlements grew; Lemon City (now Little Haiti) Coconut Grove, Biscayne in present-day Miami Shores, and Cutter in today's Palmetto Bay. Henry Flagler's railroad spurred development and migration.

The city grew from 1,681 people in 1900 to 29,549 in 1920. By the end of WWII, the population was almost half a million, and the 2010 census showed a total population for Greater Miami of 2,496,435.

The 1959 Cuban Revolution saw the first wave of middle and upper class Cubans come to Miami followed by blue collar workers. In 1965 approximately 100,000 Cuban immigrants joined the "freedom flights" and the Riverside neighborhood became known as little Havana. Little Havana is Cuban in name and history. The neighborhood now has Spanish-speaking residents from many countries such as Mexico, Nicaragua and Costa Rica.

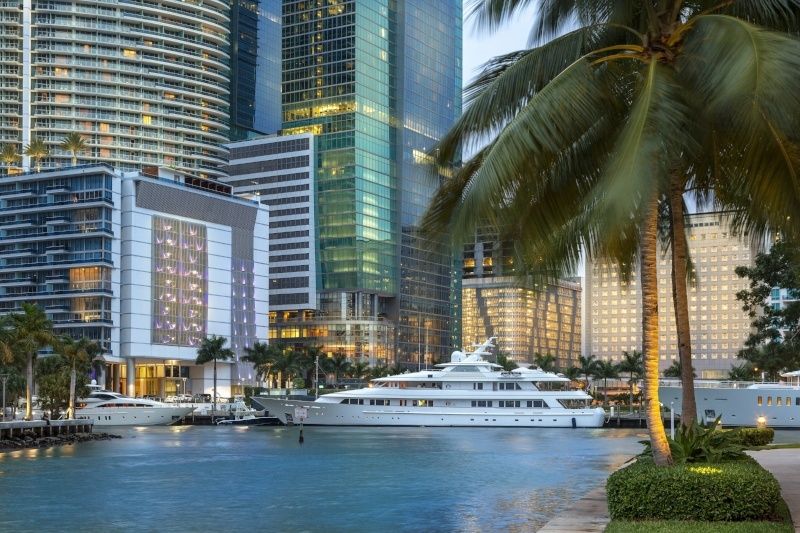

Miami was named for the Native tribe, Mayaimi, who lived around Lake Okeechobee (Big Water) until about 300 years ago. Juan Ponce de Leon was the first European to visit the area and then, in 1566, Pedro Menendez de Avilés removed the French from Florida, and established new Spanish colonies (colonias españolas.) In the early days, the area was better known as "Biscayne Bay Country" and an area that "held great promise." How right they were.

Spanish settlement continued to ebb and flow. The English began to settle the area in the 18th and 19th centuries, but the first permanent white settlement wasn't established until about 1800 when Pedro Fornells arrived on Key Biscayne.

The Seminole Wars devastated the native populations, leaving the land free for European and Bahamian settlers. The Village of Miami was charted on the south bank of the river in the early 1840s, and in 1844 Miami became the county seat. New settlers arrived, including the Brickells; still famous as a Miami neighborhood name today. New settlements grew; Lemon City (now Little Haiti) Coconut Grove, Biscayne in present-day Miami Shores, and Cutter in today's Palmetto Bay. Henry Flagler's railroad spurred development and migration.

The city grew from 1,681 people in 1900 to 29,549 in 1920. By the end of WWII, the population was almost half a million, and the 2010 census showed a total population for Greater Miami of 2,496,435.

The 1959 Cuban Revolution saw the first wave of middle and upper class Cubans come to Miami followed by blue collar workers. In 1965 approximately 100,000 Cuban immigrants joined the "freedom flights" and the Riverside neighborhood became known as little Havana. Little Havana is Cuban in name and history. The neighborhood now has Spanish-speaking residents from many countries such as Mexico, Nicaragua and Costa Rica.

-2.png?width=500&height=205&name=MIAMI%20HOME%20SEARCH%20(2)-2.png)

START YOUR SEARCH NOW