The Miami Market Right Now

Miami has fundamentally changed. The pandemic-era migration of wealth from New York, California, and Latin America wasn't a temporary spike—it was a permanent shift. Hedge funds, family offices, and tech companies have relocated. The tax advantages (no state income tax, no estate tax) are real and substantial. And Miami has made its foray into the ultra-luxury segment—a market it never really had before. Buildings like Four Seasons, St. Regis, and the automotive brands (Porsche, Aston Martin, Bentley) have brought $3,000-$5,000/SF product to a city that topped out at $1,500/SF a decade ago.

But here's what most buyers don't realize: the current wave of new development is the last of the affordable inventory. Buildings launching now were financed and constructed before tariffs of 20-50% hit steel, aluminum, concrete, and lumber. The next cycle of projects will cost 20-30% more to build—and those costs will be passed on to buyers.

It's also a tale of two markets: buildings less than 30 years old vs. buildings greater than 30 years old. Florida's new condo laws require milestone structural inspections and fully funded reserves for older buildings—which means potential special assessments. Newer construction avoids these issues entirely. The age of the building matters more now than ever.

My Take: If you're considering Miami, buy now. Current inventory is a bargain compared to what's coming. The buildings on the market today were built with pre-tariff costs. Once they sell out, replacement cost pricing takes over.

📍 Looking for specific buildings? See our complete Luxury Apartments Miami guide — 22+ hand-picked condos with floor plans, pricing, and my personal recommendations.

December 2025 Market Snapshot

|

Metric

|

December 2025

|

|

Median Condo Price (Miami Beach)

|

$620K

|

|

Median Condo Price (Brickell)

|

$580K

|

|

Luxury Condo Price Per SF

|

$1,200–$3,500+

|

|

Ultra-Luxury (Branded Residences)

|

$2,000–$5,000+/SF

|

|

Average Days on Market

|

95 days

|

Why Miami

The fundamentals that drove Miami's boom are permanent, not cyclical:

- No state income tax. Florida has no personal income tax, no estate tax, and no inheritance tax. For high earners leaving New York (10.9% top rate) or California (13.3%), the savings are substantial.

- Wealth migration. Miami's millionaire population increased 78% from 2013-2023. It's now the #1 destination for centi-millionaires ($100M+ net worth) relocating within the US.

- Global connectivity. Miami International Airport serves 150+ destinations with 23M+ international passengers annually. Direct flights to Europe, Latin America, and increasingly Asia.

- Business hub. More foreign banks than any US city. Headquarters for Latin American operations of major corporations. Citadel, Blackstone, and major hedge funds have opened offices.

- Limited land. Miami is bordered by the ocean, the bay, and the Everglades. There's no room for sprawl. This geographic constraint supports long-term values.

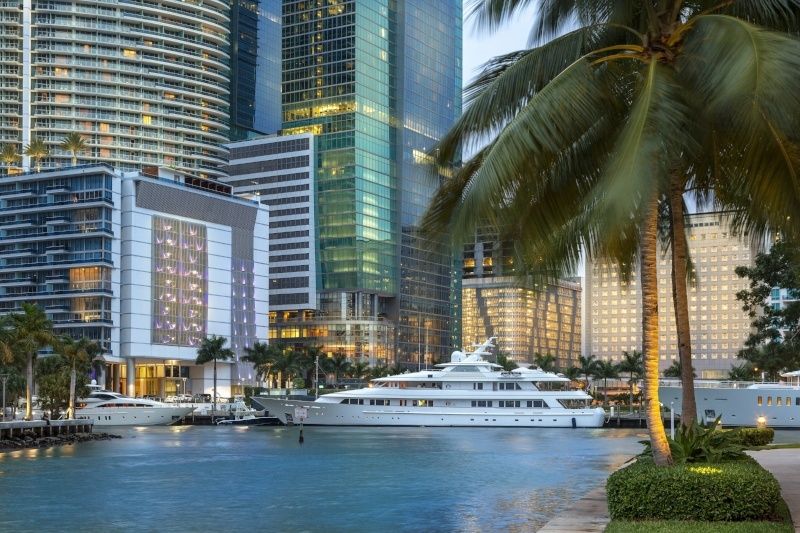

Where to Buy in Miami

Miami's neighborhoods each have distinct characters, price points, and buyer profiles. Here's my honest assessment.

Best Value Right Now

Brickell

Brickell is Miami's financial district—high-rises, young professionals, walkable urban living. The neighborhood has matured significantly with Brickell City Centre anchoring retail and dining. New developments like St. Regis Brickell and Cipriani Brickell are bringing ultra-luxury to an area that was primarily mid-market condos.

Price range: $600–$1,500/SF. My verdict: Great entry point for Miami. Strong rental demand if you need flexibility.

Edgewater

Edgewater sits between downtown and the Design District, with bay views and easy access to both. It's less dense than Brickell, more residential in feel. New developments are bringing better product to the area, and proximity to Wynwood and the Design District adds appeal.

Price range: $700–$1,200/SF. My verdict: Undervalued compared to Brickell. Good upside as the Design District continues to grow.

Downtown Miami

Downtown has transformed from a 9-to-5 business district into a genuine neighborhood. Aston Martin Residences (66 stories) has redefined what's possible here. The Kaseya Center brings events and energy. New transit connections are improving accessibility.

Price range: $600–$2,000/SF. My verdict: Aston Martin Residences elevated the entire neighborhood. More upside ahead.

Any New Development on the Market Today

This might sound like a sales pitch, but it's economics. Every new development currently selling was built with pre-tariff material costs. With tariffs of 20-50% now hitting steel, aluminum, concrete, and lumber, the next generation of buildings will cost 20-30% more to construct—and those costs will be passed on to buyers. The buildings on the market today are the last of the "cheap" inventory. Once they sell out, replacement cost pricing takes over.

My verdict: Buy now. Current inventory is a bargain compared to what's coming next.

Trophy Neighborhoods

Fisher Island

Fisher Island is accessible only by ferry—no bridge, no tourists, complete privacy. It has the highest per-capita income of any zip code in America. The island has its own school, golf course, marina, and beach club. Six Fisher Island, the newest development, is bringing contemporary product to an island that needed it.

Price range: $2,000–$4,500/SF. My verdict: The most exclusive address in Miami. If privacy is paramount, this is it.

Sunny Isles Beach

Sunny Isles has become Miami's "Billionaire's Row"—a concentration of ultra-luxury branded residences unlike anywhere else in the US. The Porsche Design Tower (with car elevators to your unit), Ritz-Carlton Residences, Turnberry Ocean Club, and the upcoming Bentley Residences define the skyline. Direct beach access, no property tax for non-residents, and proximity to Bal Harbour shopping.

Price range: $1,500–$3,500/SF. My verdict: The concentration of branded residences here is unmatched. If you want a trophy condo with hotel services, this is the place.

Miami Beach (South of Fifth / SoFi)

South of Fifth is the most exclusive part of Miami Beach—a quiet residential enclave at the southern tip of the island with Biscayne Bay on one side and the Atlantic on the other. Continuum, Apogee, Glass are landmark buildings. It's walkable to South Beach nightlife but insulated from the chaos.

Price range: $1,800–$4,000/SF. My verdict: Best of both worlds—beach lifestyle with neighborhood feel. Limited new inventory keeps values strong.

Surfside

Surfside is a small, quiet beachfront town between Miami Beach and Bal Harbour. The Four Seasons Surf Club redefined the area—bringing Five-star service to a low-key neighborhood. It's walkable, family-oriented, and has direct beach access without the density of Sunny Isles or the scene of South Beach.

Price range: $1,500–$3,000/SF. My verdict: Four Seasons Surf Club is one of the best branded residences in Miami. Quiet sophistication.

Bal Harbour

Bal Harbour is synonymous with luxury—home to the iconic Bal Harbour Shops, one of the highest-grossing malls per square foot in the US. The beachfront village sits between Surfside and Sunny Isles with a distinct old-money feel. Oceana Bal Harbour and The Ritz-Carlton Residences Bal Harbour set the standard. Limited inventory because there's simply no room to build—the village is fully developed.

Price range: $1,800–$3,500/SF. My verdict: Ultra-exclusive with nowhere to expand. Bal Harbour Shops alone makes this a destination.

Coconut Grove

Coconut Grove is Miami's original neighborhood—a bohemian enclave with a peaceful marina, tree-lined streets, and a quaint village feel. The new Four Seasons Coconut Grove has elevated the area with ultra-luxury residences. Inventory is limited because the neighborhood is largely built out and fiercely protected by longtime residents. It's also just minutes from Brickell, making it ideal for those who want tranquility without sacrificing access to the financial district.

Price range: $1,200–$2,500/SF. My verdict: Rare inventory in a neighborhood that resists change. Four Seasons brought world-class product to a boho enclave on the water.

Branded Residences: Miami's Defining Trend

Miami has more branded residences than any city in the Western Hemisphere. These hotel-branded condominiums offer Five-star services, luxury finishes, and the cachet of globally recognized names. They also tend to hold value better than non-branded buildings.

|

Property

|

Location

|

Price/SF

|

|

Four Seasons Surf Club

|

Surfside

|

$2,200–$3,500

|

|

Four Seasons Coconut Grove

|

Coconut Grove

|

$1,800–$2,500

|

|

St. Regis Sunny Isles

|

Sunny Isles Beach

|

$1,800–$2,800

|

|

St. Regis Brickell

|

Brickell

|

$1,600–$2,400

|

|

Ritz-Carlton Sunny Isles

|

Sunny Isles Beach

|

$1,500–$2,500

|

|

Ritz-Carlton Bal Harbour

|

Bal Harbour

|

$2,000–$3,200

|

|

Six Fisher Island

|

Fisher Island

|

$3,000–$4,500

|

|

Aston Martin Residences

|

Downtown Miami

|

$1,400–$2,200

|

|

Porsche Design Tower

|

Sunny Isles Beach

|

$1,600–$2,400

|

|

Cipriani Brickell

|

Brickell

|

$1,800–$2,600

|

|

888 Brickell (Dolce & Gabbana)

|

Brickell

|

$1,600–$2,200 (pre-con)

|

|

Ritz-Carlton Miami Beach

|

Mid-Beach

|

$1,800–$3,000

|

|

Mandarin Oriental Brickell Key

|

Brickell Key

|

$1,600–$2,400 (pre-con)

|

|

The Raleigh

|

Mid-Beach

|

$2,500–$4,000 (pre-con)

|

|

St. Regis Bahia Mar

|

Ft. Lauderdale

|

$1,400–$2,200 (pre-con)

|

|

Bentley Residences

|

Sunny Isles Beach

|

$2,500–$3,500 (pre-con)

|

→ Full building details: See floor plans, amenities, and my expert picks in our Luxury Apartments Miami guide.

My Take: Branded residences command a premium, but they deliver real value: professional management, hotel services, and stronger resale. For international buyers who won't use the property full-time, the rental programs and property management make ownership seamless.

International Buyers: Miami is Built for You

Over 70% of my clients are international buyers. Miami is the most foreign-buyer-friendly market in the United States—and it's not close.

- No restrictions on foreign ownership. Unlike co-ops in New York, Miami condos welcome international buyers without discrimination.

- SB 264 restriction (important): Florida SB 264 restricts property purchases by nationals of certain countries (China, Russia, Iran, North Korea, Cuba, Venezuela, Syria) within 10 miles of military installations or critical infrastructure. This affects much of South Florida. Buyers from these countries should consult an attorney before purchasing.

- EB-5 investor visas. Several Miami developments qualify for the EB-5 program, offering a path to US residency through real estate investment.

- Latin American hub. More foreign banks than any US city. Spanish and Portuguese widely spoken. Direct flights throughout Latin America.

- Financing available. HSBC, Citibank, and specialized lenders offer mortgages to foreign nationals. Expect 30-40% down and slightly higher rates.

- FIRPTA withholding. When you sell, 15% of the sale price is withheld for potential capital gains tax. You can file for a refund if your actual tax liability is lower.

- Estate planning. US real estate is subject to US estate tax for non-residents. Consider holding through an LLC or foreign corporation—consult a cross-border tax attorney.

Best buildings for international buyers: Four Seasons Surf Club, Four Seasons Coconut Grove, St. Regis (Sunny Isles, Brickell, and Bahia Mar), Ritz-Carlton Miami Beach, Mandarin Oriental Brickell Key, Cipriani, 888 Brickell (Dolce & Gabbana), and Aston Martin Residences. These buildings have rental programs, professional management, and experience handling remote owners.

Carrying Costs: What You'll Pay Monthly

Beyond the purchase price, Miami condos have ongoing costs. Understanding these is critical to budgeting—especially for international buyers managing properties remotely.

HOA Fees (Maintenance)

- Range: $0.80–$2.50/SF monthly. A 2,000 SF condo typically pays $1,600–$5,000/month depending on building amenities and services.

- What's included: Building insurance, common area maintenance, amenities (pool, gym, concierge), reserves, and often water. Luxury buildings with extensive services are at the higher end.

- Branded residences: Expect premium HOA fees ($2.00–$3.00+/SF) for hotel-level services, but you get concierge, valet, housekeeping options, and rental management.

Property Taxes

- Rate: Approximately 2% of assessed value annually in Miami-Dade County.

- Homestead exemption: Florida residents using the property as primary residence can claim up to $50,000 exemption, significantly reducing taxes. Also caps annual assessment increases at 3%.

- Non-residents: No homestead exemption. Full assessed value taxed. International buyers and second-home owners pay more.

Insurance

- Building insurance: Covered in HOA fees. Well-managed newer buildings have lower premiums.

- Unit owner (HO-6) policy: Required for interior coverage, personal property, and liability. Budget $2,000–$5,000+ annually depending on unit value and building age.

- Flood insurance: Required if financing. Even in high-rises, lenders require it. Budget $500–$3,000+ annually.

- Windstorm: Often separate from standard HO-6. Can be significant—this is Florida. Newer buildings with hurricane-rated windows have lower premiums.

Special Assessments

- What they are: One-time charges for major repairs or improvements not covered by reserves (roof replacement, facade work, elevator modernization).

- Risk factor: Older buildings (30+ years) face milestone inspection requirements and mandatory reserve funding under Florida's new condo laws. Buildings that deferred maintenance may face significant assessments.

- How to protect yourself: Review reserve study, recent board minutes, and any pending engineering reports before purchasing. Ask about planned capital improvements.

My Take: Newer buildings (under 20 years) with strong reserves are your safest bet. The carrying cost difference between a well-run new building and an older building facing assessments can be enormous. I always review financials before recommending a building to clients.

The Buying Process in Miami

Miami's process is more straightforward than New York. No board approvals, no invasive financial reviews, no co-op politics.

|

Step

|

Timeline & Details

|

|

1. Search

|

1-4 weeks. Define requirements, tour properties, identify targets.

|

|

2. Offer

|

Submit offer with proof of funds or pre-approval. Negotiate terms.

|

|

3. Contract

|

Sign purchase agreement. Deposit typically 10% (held in escrow).

|

|

4. Inspection

|

15-day inspection period (negotiable). Review condo docs, assess unit condition.

|

|

5. Financing

|

Finalize mortgage if applicable. Appraisal, underwriting, commitment.

|

|

6. Closing

|

30-45 days from contract (cash), 45-60 days (financed). Title transfer, keys.

|

Closing Costs to Budget

- Title Insurance: ~0.5-0.6% of purchase price

- Documentary Stamps: 0.7% (Miami-Dade County)

- Title Search & Settlement: $1,000-$2,500

- Lender Fees (if financing): 1-2% of loan amount

- Intangible Tax (if financing): 0.2% of mortgage amount

Rule of Thumb: Budget 2-3% of purchase price for closing costs (cash), 3-4% (financed). Much lower than New York.

Insurance & Florida's New Condo Laws

Post-Surfside, Florida enacted significant condo reform. Buyers need to understand these changes—they affect both carrying costs and building quality.

Insurance Reality

Florida condo insurance costs have increased significantly since 2021. Several insurers have left the market. This is a real cost that buyers must budget for.

- Building insurance: Covered by HOA fees. Well-managed buildings in newer construction have lower premiums.

- Unit owner (HO-6) policy: You need this for interior coverage, personal property, and liability. Budget $2,000-$5,000+ annually depending on unit value and location.

- Flood insurance: Required if you finance. Even in high-rises, ground-floor amenities can flood. Budget $500-$3,000+ annually.

My Take: Newer buildings (post-2000) with concrete construction generally have lower insurance costs. I always review a building's insurance situation before recommending it to clients.

Florida's Milestone Inspection & Reserve Requirements

Florida SB 4D (passed after Surfside) requires:

- Milestone inspections: Buildings 3+ stories must have structural inspections at 30 years (25 years if within 3 miles of coast), then every 10 years.

- Structural Integrity Reserve Study (SIRS): Required every 10 years. Associations must fund reserves for roof, structure, electrical, plumbing, and waterproofing—no more waiving reserves.

- What this means for buyers: Older buildings may face special assessments to fund required repairs. Always review reserve studies and recent board minutes before purchasing.

Silver lining: These laws make Miami condos safer long-term. Well-capitalized buildings with strong reserves are now clearly differentiated from underfunded ones. Quality buildings will hold value better.

Miami vs. New York: Real Estate Comparison

Many of my clients are New Yorkers buying in Miami—either relocating or purchasing a second home. Here's how the markets compare:

|

Factor

|

Miami

|

New York

|

|

State Income Tax

|

0%

|

10.9%

|

|

City Income Tax

|

0%

|

3.88%

|

|

Estate Tax

|

None

|

Up to 16%

|

|

Luxury Condo $/SF

|

$1,200–$3,500

|

$1,800–$4,500

|

|

Closing Costs

|

2-3%

|

4-6%

|

|

Board Approval

|

None

|

Co-ops: Invasive

|

|

Time to Close

|

30-45 days

|

60-120 days

|

|

Rental Restrictions

|

Minimal in most condos

|

Co-ops: Strict limits

|

|

Foreign Buyers

|

Welcome

|

Co-ops: Often restricted

|

The Math: A high earner making $1M/year saves ~$150,000 annually in state and city income taxes by establishing Florida residency. Over 10 years, that's $1.5M+ in tax savings—enough to pay for a significant portion of a Miami condo. This is why wealth migration to Miami isn't slowing down.

Miami vs. Los Angeles: Tax Savings Comparison

California residents are increasingly looking at Miami as an alternative—same sunshine, beaches, and lifestyle, but dramatically different tax treatment.

|

Factor

|

Miami

|

Los Angeles

|

|

State Income Tax

|

0%

|

13.3%

|

|

Capital Gains Tax

|

0% state

|

13.3%

|

|

Estate Tax

|

None

|

None (but federal applies)

|

|

Luxury Condo $/SF

|

$1,200–$3,500

|

$1,500–$4,000

|

|

Waterfront Access

|

Abundant

|

Limited high-rise options

|

|

Branded Residences

|

20+ options

|

Limited

|

|

International Flights

|

Latin America, Europe hub

|

Asia-Pacific hub

|

The Math: A California resident with $2M in annual income (salary + capital gains) saves ~$250,000+ annually by establishing Florida residency. Founders selling a company face state capital gains tax of 13.3% in California vs. 0% in Florida—on a $50M exit, that's $6.65M in savings. This is why tech founders are relocating.

Important: Establishing Florida residency requires more than buying property. You need to actually live here, change your driver's license, register to vote, and meet other domicile requirements. Consult a tax attorney before making the move.

Frequently Asked Questions

Can foreigners buy property in Miami?

Yes. There are no restrictions on foreign ownership of Miami real estate. No visa or residency required. Miami is the most foreign-buyer-friendly market in the US. Financing is available through select international lenders with 30-40% down.

What are closing costs in Miami?

Budget 2-3% for cash purchases, 3-4% if financing. This includes title insurance (~0.5%), documentary stamps (0.7%), title search, and lender fees if applicable. Significantly lower than New York's 4-6%.

What is the best neighborhood in Miami for investment?

Brickell offers strong rental demand and liquidity. Edgewater is undervalued with upside. For long-term appreciation, waterfront properties in Sunny Isles, Surfside, and Fisher Island have historically held value best. Branded residences tend to outperform non-branded buildings.

How much are HOA fees in Miami condos?

Expect $0.80-$2.00+ per square foot monthly. Luxury buildings with extensive amenities (pools, gyms, concierge, valet) are at the higher end. A 2,000 SF condo might have HOA fees of $1,600-$4,000/month depending on the building and services included.

How much is property insurance in Miami?

Building insurance is covered by HOA fees. You'll need an HO-6 policy for your unit: budget $2,000-$5,000+ annually. Flood insurance (required if financing) adds $500-$3,000+ annually. Newer concrete construction typically has lower premiums.

What are Florida's new condo laws?

Post-Surfside, Florida requires milestone structural inspections for buildings 3+ stories at 30 years (25 if coastal), then every 10 years. Associations must fund reserves for structural components—no more waiving reserves. This makes older buildings potentially subject to special assessments but improves safety long-term.

Can I rent out my Miami condo?

Most Miami condos allow rentals with minimal restrictions. Some buildings limit short-term rentals (Airbnb-style) but allow annual leases. Branded residences often have rental programs that handle everything for absentee owners. Always verify the specific building's rules before purchasing.

How long does it take to buy a condo in Miami?

30-45 days for cash purchases, 45-60 days if financing. No board approval process like New York co-ops. The timeline includes inspection period (typically 15 days), title search, and closing preparation. Much faster than New York's 60-120 day process.

Miami vs New York: which is better for real estate investment?

Different markets for different goals. Miami offers: no state income tax, lower closing costs, easier buying process, no board approvals, and better rental flexibility. New York offers: deeper market liquidity, stronger long-term appreciation history, and global brand recognition. Many investors own in both markets.

Why Work With Manhattan Miami Real Estate

I've been selling Miami real estate since 2005. Over 70% of my clients are international buyers—from Brazil, Europe, Asia, and the Middle East. I understand the unique challenges: remote transactions, financing for foreign nationals, FIRPTA planning, and finding the right building for owners who won't be there full-time.

- Market knowledge: I track every new development, every price change, every building's sales velocity. The analysis in this guide comes from that daily work.

- Pre-construction access: I work directly with developers and have access to pre-construction pricing before public launch.

- Negotiation: I know which developers are motivated, which buildings are struggling, and where there's room to negotiate. I've secured significant discounts, closing cost credits, and upgrade packages for clients.

- Full service: From search to closing to property management and eventual resale. I'm here for the long term.

Buyer representation is free—sellers pay the commission.

Anthony Guerriero

Licensed Real Estate Broker

Manhattan Miami Real Estate LLC

Licensed in NY, FL

aguerriero@manhattanmiami.com

Explore Further

🏢 Building Directory: For detailed building profiles, floor plans, and my personal recommendations, see Best Luxury Condos in Miami 2025 — 22+ hand-picked properties with expert picks.

Neighborhoods

Property Types

Featured Buildings

Buyer Resources

Last Updated: December 2025

-2.png?width=500&height=205&name=MIAMI%20HOME%20SEARCH%20(2)-2.png)

START YOUR SEARCH NOW