Manhattan Condo and Co-op Sales Surge to Two-Year High

The Manhattan real estate market delivered exceptional performance in the third quarter of 2025, with residential sales reaching their highest level in over two years. The market is trending positively, with rising sales and price growth indicating strong momentum.

This comprehensive market analysis examines current trends in Manhattan condos, co-ops, luxury properties, and new developments based on the latest Douglas Elliman market report.

Executive Summary: Manhattan Housing Market Q3 2025

Manhattan’s residential real estate market demonstrated remarkable strength in Q3 2025, with 3,158 closed sales representing a 13.4% year-over-year increase—the strongest quarterly performance since 2023. The Manhattan condo market and co-op sector both posted double-digit sales growth, while median sales prices rose 5.8% to $1,180,000.

Key Manhattan Market Highlights:

-

Manhattan home sales reached 3,158 closings, up 13.4% annually

-

Median Manhattan condo price: $1,650,000 (+2.2% YoY)

Manhattan’s median condo price is significantly higher than the national average, highlighting the substantial disparity in housing costs.

-

Median Manhattan co-op price: $870,000 (+3.6% YoY)

Housing costs, including property taxes and maintenance fees, play a major role in overall affordability for buyers.

-

Cash transactions dominated at 65.3% of all sales

-

Manhattan luxury real estate inventory declined 16.1% year-over-year

-

New development sales surged 71% annually

Manhattan Condo Market Analysis Q3 2025

Manhattan Condo Sales and Pricing

The Manhattan condo market posted impressive gains in Q3 2025, with 1,407 condo closings—a 16.6% year-over-year increase. This represents the strongest quarterly performance for Manhattan condos in recent years.

Manhattan Condo Market Metrics:

-

Median condo price: $1,650,000, up 2.2% year-over-year

-

Average condo price: $2,651,636, down 5.1% (reflecting unit mix shift)

-

Average price per square foot: $1,998, down 2.3%

-

Higher mortgage rates have led to increased monthly payments for buyers, making homeownership less affordable and influencing some to reconsider their purchase decisions.

-

Days on market: 74 days, down 3.9% annually

-

Condo inventory: 4,064 units, up 8.3%

Nearly 70% of Manhattan condo sales were all-cash transactions during Q3, demonstrating the strong presence of well-capitalized buyers in the market. Sales over $2 million showed particularly robust growth, rising at triple the rate of properties under $2 million.

Manhattan Condo Prices by Bedroom Count

Bedroom TypeMedian Sale Price Q3 2025Year-over-Year ChangeStudio Condos$693,500N/A1-Bedroom Condos$1,135,000N/A2-Bedroom Condos$2,150,000Strong demand3-Bedroom Condos$3,917,500Premium segment4+ Bedroom Condos$6,601,289Luxury tier

Manhattan Co-op Market Analysis Q3 2025

Manhattan Co-op Sales Performance

The Manhattan co-op market demonstrated strong momentum with 1,751 closings in Q3 2025, representing an 11.0% year-over-year increase. Co-op sales growth outpaced condo percentage gains, signaling renewed buyer interest in this traditional Manhattan property type.

Manhattan Co-op Market Metrics:

-

Median co-op price: $870,000, up 3.6% year-over-year

-

Average co-op price: $1,456,738, up 8.3%

-

Average price per square foot: $1,170, down 1.1%

-

Days on market: 79 days, down 4.8% annually

-

Co-op inventory: 3,669 units, up 5.7%

-

Co-op maintenance fees: $3,054 average monthly, up 8.1% ($2.45/sq ft/month)

These housing costs, including maintenance fees and property taxes, directly impact buyers' purchasing power and overall affordability, especially as rate-driven affordability constraints persist.

More than 60% of Manhattan co-op sales were all-cash purchases, with the cash share rising even higher for premium properties.

Manhattan Co-op Prices by Bedroom Count

Bedroom TypeMedian Sale Price Q3 2025Studio Co-ops$465,0001-Bedroom Co-ops$700,0002-Bedroom Co-ops$1,285,0003-Bedroom Co-ops$2,171,2504+ Bedroom Co-ops$3,875,000

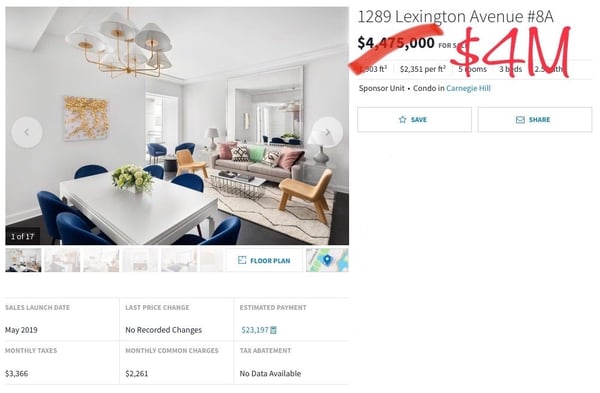

Manhattan Luxury Real Estate Market Q3 2025

Luxury Manhattan Condo and Co-op Sales

The Manhattan luxury real estate market (top 10% of sales) showed exceptional strength despite elevated mortgage rates, with 318 luxury sales representing a 13.6% year-over-year increase. Perhaps most notably, luxury inventory declined dramatically while sales grew—a powerful indicator of sustained high-end demand.

Manhattan Luxury Market Metrics:

-

Luxury threshold: $4,000,000 (entry point for top 10%)

-

Median luxury sale price: $5,922,500, up 2.8% year-over-year

-

Average luxury price: $7,891,731

-

Average luxury price per square foot: $2,535

-

Luxury sales: 318 closings, up 13.6% annually

-

Luxury inventory: 1,317 units, down 16.1% year-over-year

-

Luxury months of supply: 12.4 months, down from 16.8 months (26.2% improvement)

The combination of declining luxury inventory and robust sales has resulted in a seller's market for luxury properties.

The luxury segment split:

-

Luxury co-ops: 55.3% of luxury sales, median $4,200,000

-

Luxury condos: 44.7% of luxury sales, median $10,182,995

Manhattan Luxury Real Estate Trends

"In stark contrast to the overall market's 7% inventory growth, the luxury market experienced a 16.1% decline in listing inventory," creating significant upward pricing pressure at the high end. 90% of Manhattan sales above $3 million were cash transactions, demonstrating the financial strength of luxury buyers.

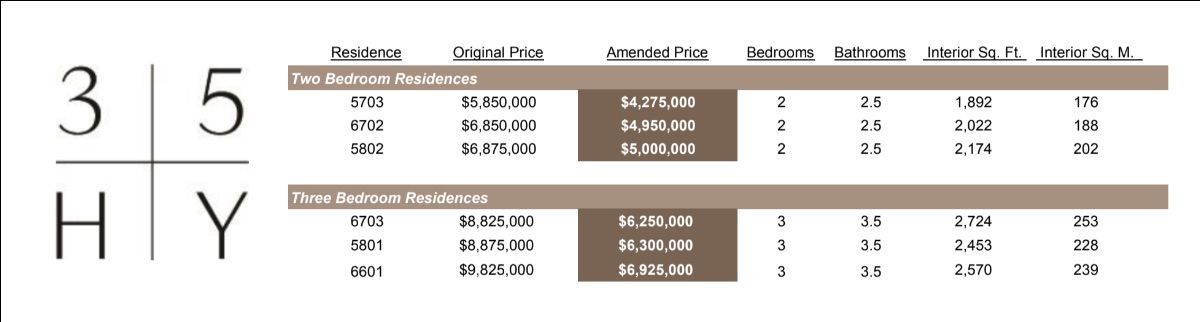

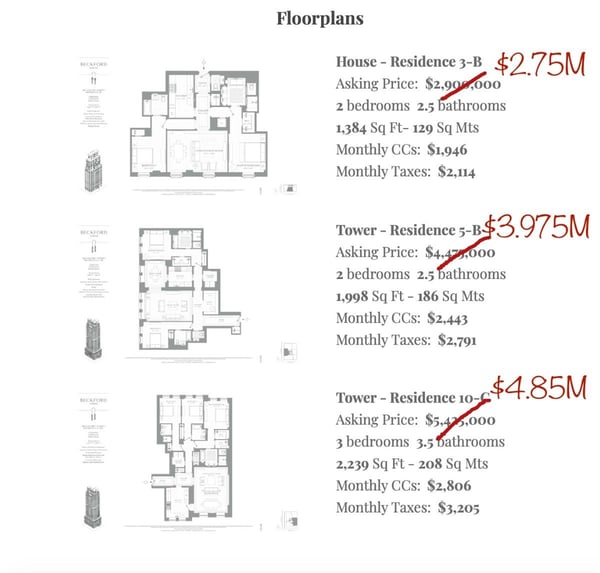

Manhattan New Development Market Q3 2025

New Development Condo Sales Surge

Manhattan new development sales posted exceptional growth in Q3 2025, with 578 closings representing a 71% year-over-year increase—the highest market share for new developments in more than six years.

Manhattan New Development Metrics:

-

New development sales: 578 closings, up 71.0% annually

-

Market share: 18.3% of all Manhattan sales

-

Median new development price: $1,750,000

-

Average price per square foot: $2,206

-

Months of supply: 6.1 months (fastest pace in 3+ years)

-

Inventory: 1,174 units

The surge in new development activity was driven by completions across multiple price points:

-

Sales under $1M: +112.3% year-over-year

-

Sales $1M-$3M: +72.3% year-over-year

-

Sales over $3M: +43.9% year-over-year

New development represented 31.8% of all luxury sales, with a median price of $6,250,000 for luxury new development units.

Limited new development and supply constraints are expected to persist over the next few years, maintaining a tight market outlook.

Manhattan Real Estate Market Trends and Conditions

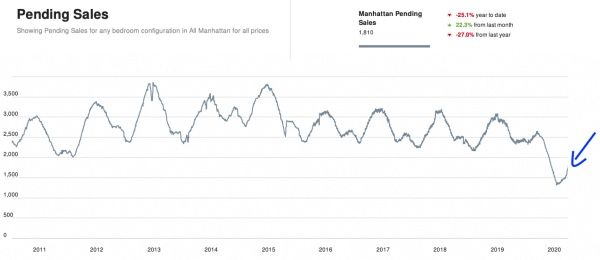

Sales Activity and Market Velocity

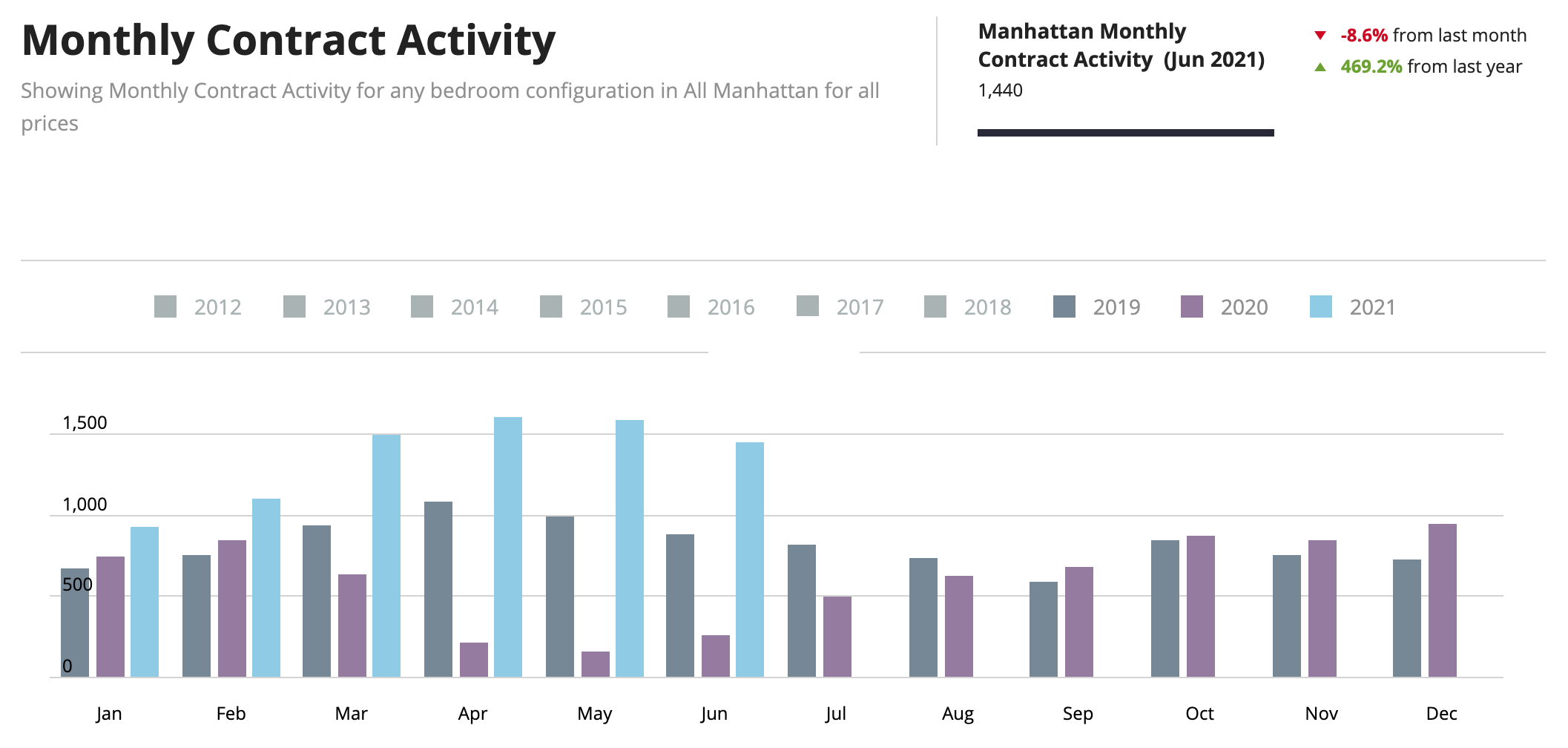

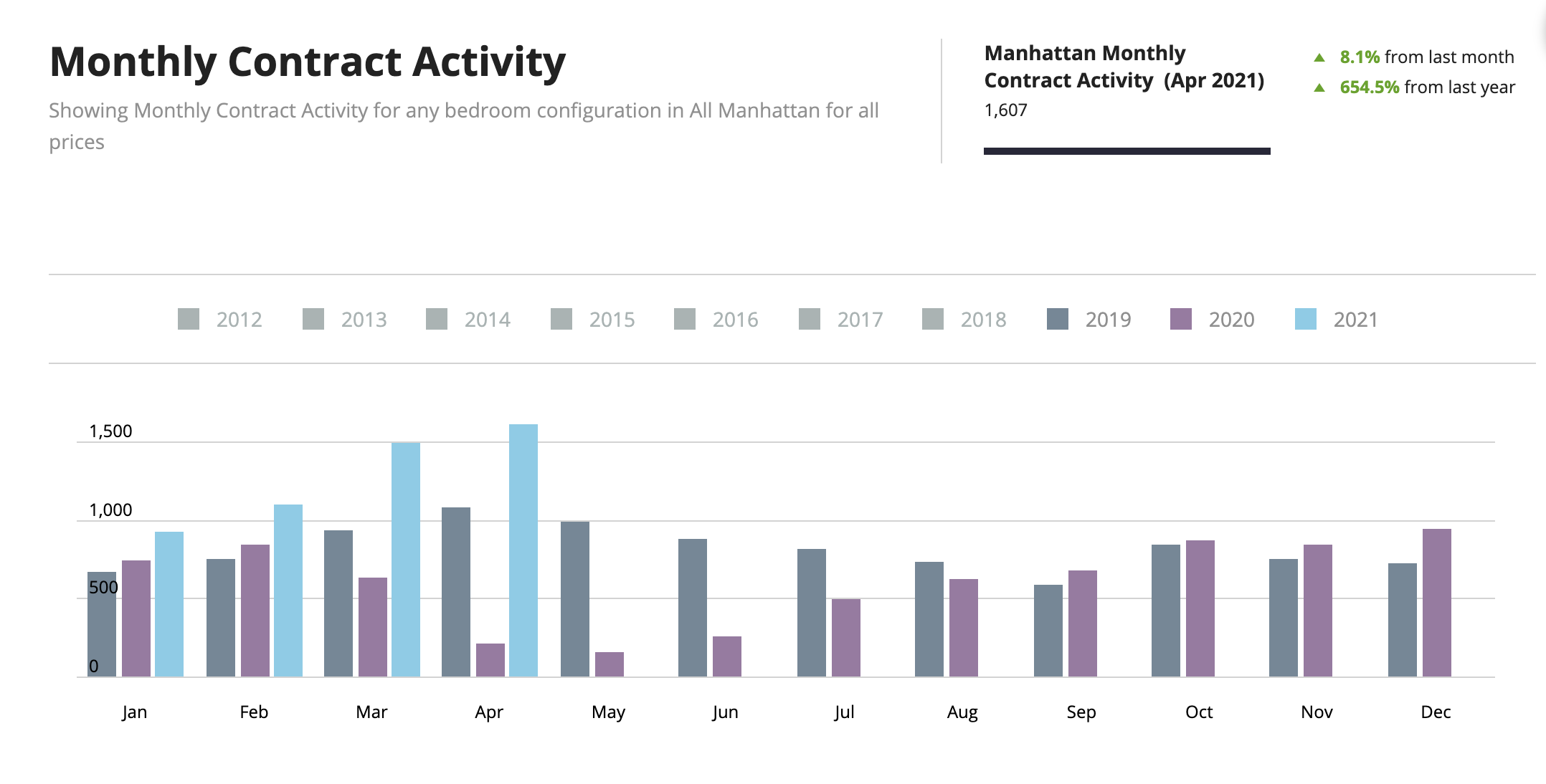

Manhattan real estate sales velocity increased significantly in Q3 2025, with the market posting its third consecutive quarter of year-over-year sales growth. The 3,158 closings came in 4.3% higher than the 10-year Q3 average of 3,029 sales, demonstrating that current activity exceeds historical norms.

Notably, Manhattan has now experienced six consecutive quarters of positive contract activity or sales growth, underscoring the market's durable performance.

Market velocity indicators:

-

Days on market: 77 days (from last list date), down 3.8% annually

-

Months of supply: 7.3 months, down 6.4% year-over-year

-

Listing discount: 6.2% (consistent with 10-year average of 5.9%)

-

Bidding wars: 4.7% of sales (down from 9.7% last year)

“It’s not blazing, but the market is slowly getting faster,” according to report author Jonathan Miller.

Manhattan Real Estate Inventory Levels

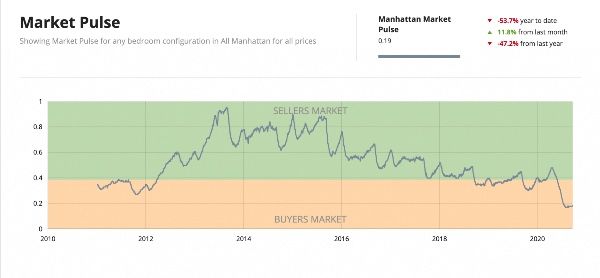

Total Manhattan housing inventory reached 7,733 listings at quarter-end, up 7.0% year-over-year. However, because sales grew faster than inventory (+13.4% vs. +7.0%), the market continued to tighten throughout the quarter.

This marked the third consecutive quarter where sales outpaced inventory growth, creating sustained upward pressure on Manhattan real estate prices across all property types.

Inventory breakdown:

-

Resale inventory: 6,559 units (+9.1% YoY)

-

Co-op inventory: 3,669 units (+5.7% YoY)

-

Condo inventory: 4,064 units (+8.3% YoY)

-

New development inventory: 1,174 units (-3.1% YoY)

-

Luxury inventory: 1,317 units (-16.1% YoY)

Note: The inventory figures above are for reference only and may be subject to change as new data becomes available.

Cash Buyers Dominate Manhattan Real Estate Market

Record Cash Transaction Levels

Cash purchases continued to dominate the Manhattan real estate market in Q3 2025, representing 65.3% of all transactions—well above the 10-year average of 52.2%. This cash dominance reflects buyers with substantial resources navigating elevated mortgage rates.

Cash vs. financed buyer trends:

-

Cash buyers increased 31% year-over-year

-

Financed buyers decreased 9.2% annually

-

90% of sales above $3 million were cash transactions

-

Cash share of luxury sales remained elevated throughout the quarter

The shift toward cash buyers accelerated following the rise in mortgage rates of more than 50 basis points since early August 2025. Well-capitalized purchasers—including trade-up buyers with substantial home equity—continued to drive market activity.

Manhattan Condo and Co-op Price Trends

Overall Manhattan Real Estate Pricing

For the third consecutive quarter, both median and average Manhattan real estate prices rose together—a pattern not consistently seen since 2022. This dual appreciation across price metrics indicates broad-based market strength.

Manhattan price metrics Q3 2025:

-

Overall median price: $1,180,000, up 5.8% year-over-year

-

Overall average price: $1,989,107, up 0.8% annually

-

Average price per square foot: $1,552

-

Resale median price: $1,026,500, up 2.7% annually

Price Appreciation Drivers

Several factors contributed to Manhattan real estate price appreciation in Q3:

-

Sales mix shift: Properties over $2 million rose at triple the rate of sub-$2M sales

-

Luxury strength: High-end sales pushed overall median prices higher

-

Inventory constraints: Supply growing slower than demand in key segments

-

Cash buyer dominance: Well-capitalized buyers less sensitive to pricing

Manhattan Real Estate Market Forecast Q4 2025 and Beyond

Near-Term Manhattan Market Outlook

The Manhattan real estate market enters Q4 2025 from a position of considerable strength, though several factors will influence near-term performance:

Positive indicators:

-

Year-to-date sales up 18.7% through Q3

-

Sales running 4.3% above 10-year averages

-

Luxury inventory constraints supporting high-end pricing

-

Sustained cash buyer presence providing market stability

-

Months of supply faster than decade norms

Considerations:

-

Mortgage rates rose 50+ basis points since early August

-

Impact of rate increases not yet fully reflected in demand

-

Mayoral election creating some uncertainty (though limited impact on market fundamentals, as housing policy falls under state authority)

2026 Manhattan Real Estate Projections

"If mortgage rates stabilize or decrease by year's end, a rise in sales next quarter seems likely," according to the Douglas Elliman report. The fundamentals driving Manhattan's market—employment strength, limited new supply, and its position as a global financial center—remain intact.

Key factors supporting 2026 outlook:

-

Supply constraints: New development inventory at lowest levels in years

-

Luxury momentum: Severe inventory shortage in high-end segment

-

Cash cushion: Two-thirds of buyers paying cash reduces rate sensitivity

-

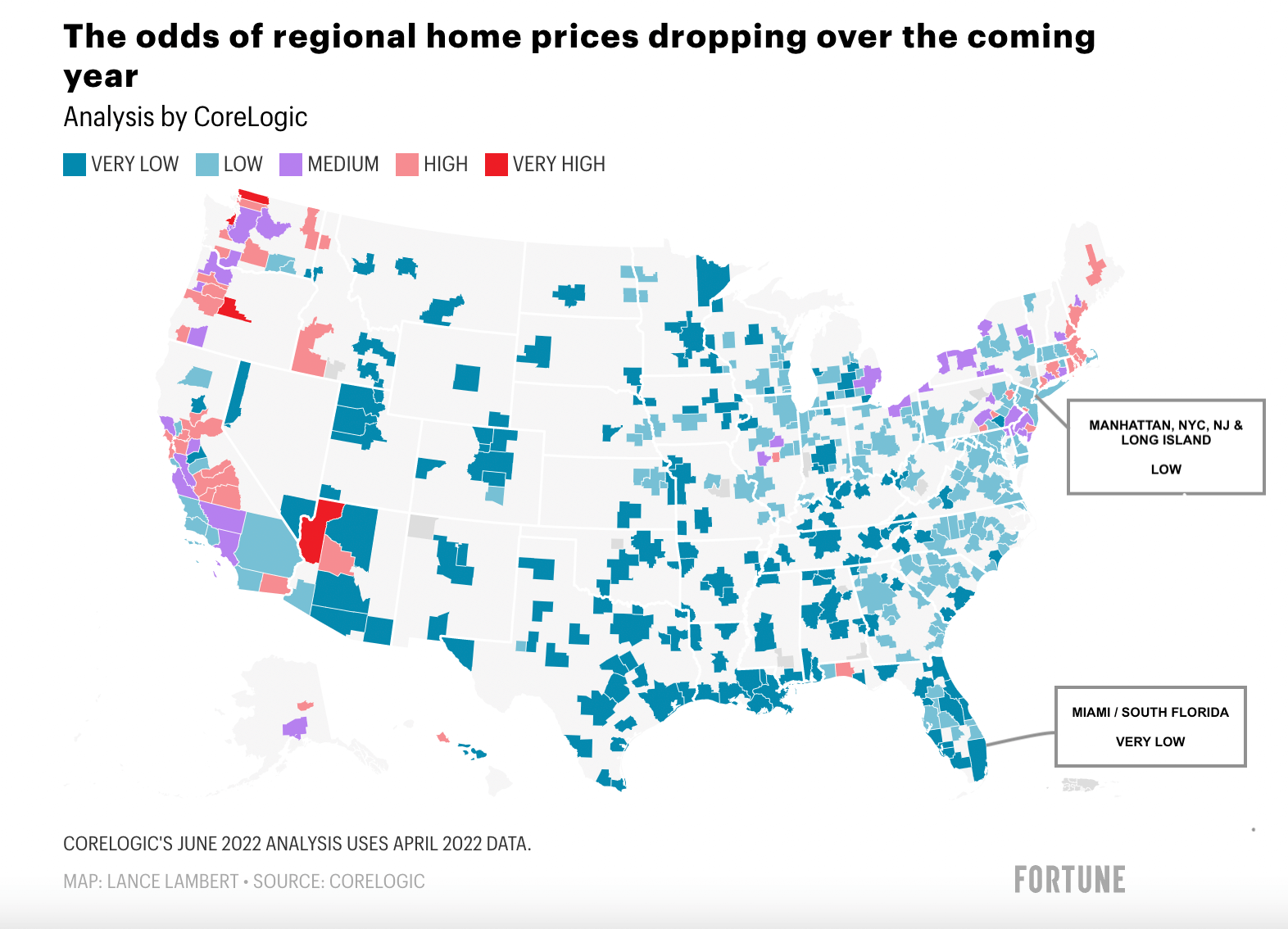

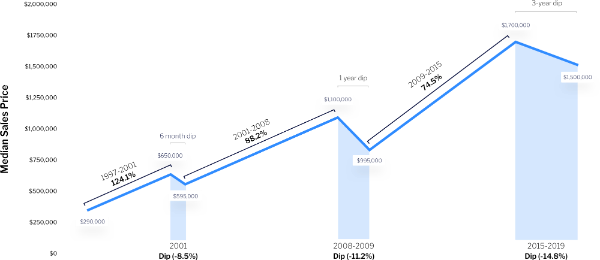

Historical resilience: Manhattan has consistently outperformed national trends

-

Pent-up demand: Financed buyers waiting for improved rate environment

Manhattan Neighborhoods and Submarkets

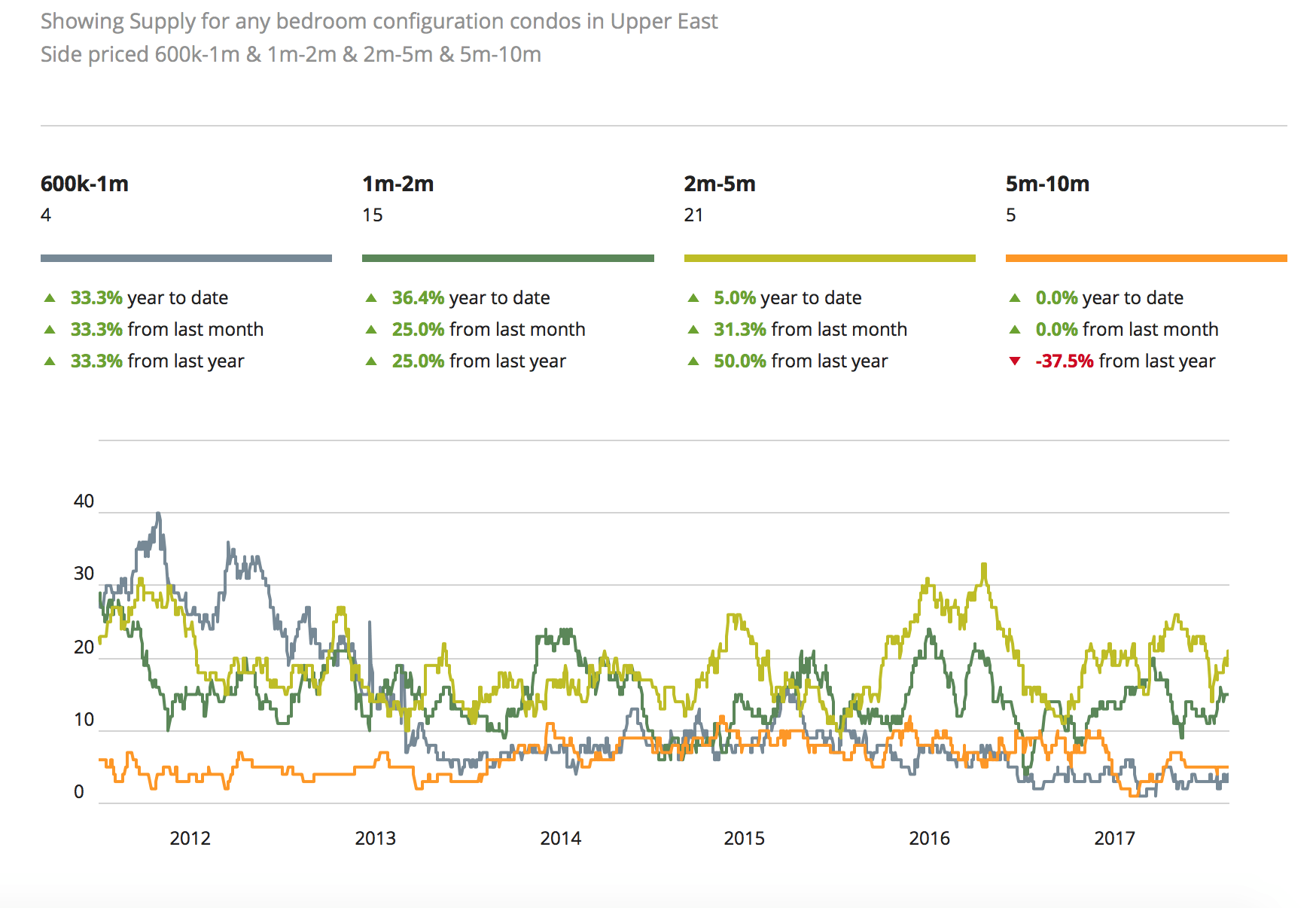

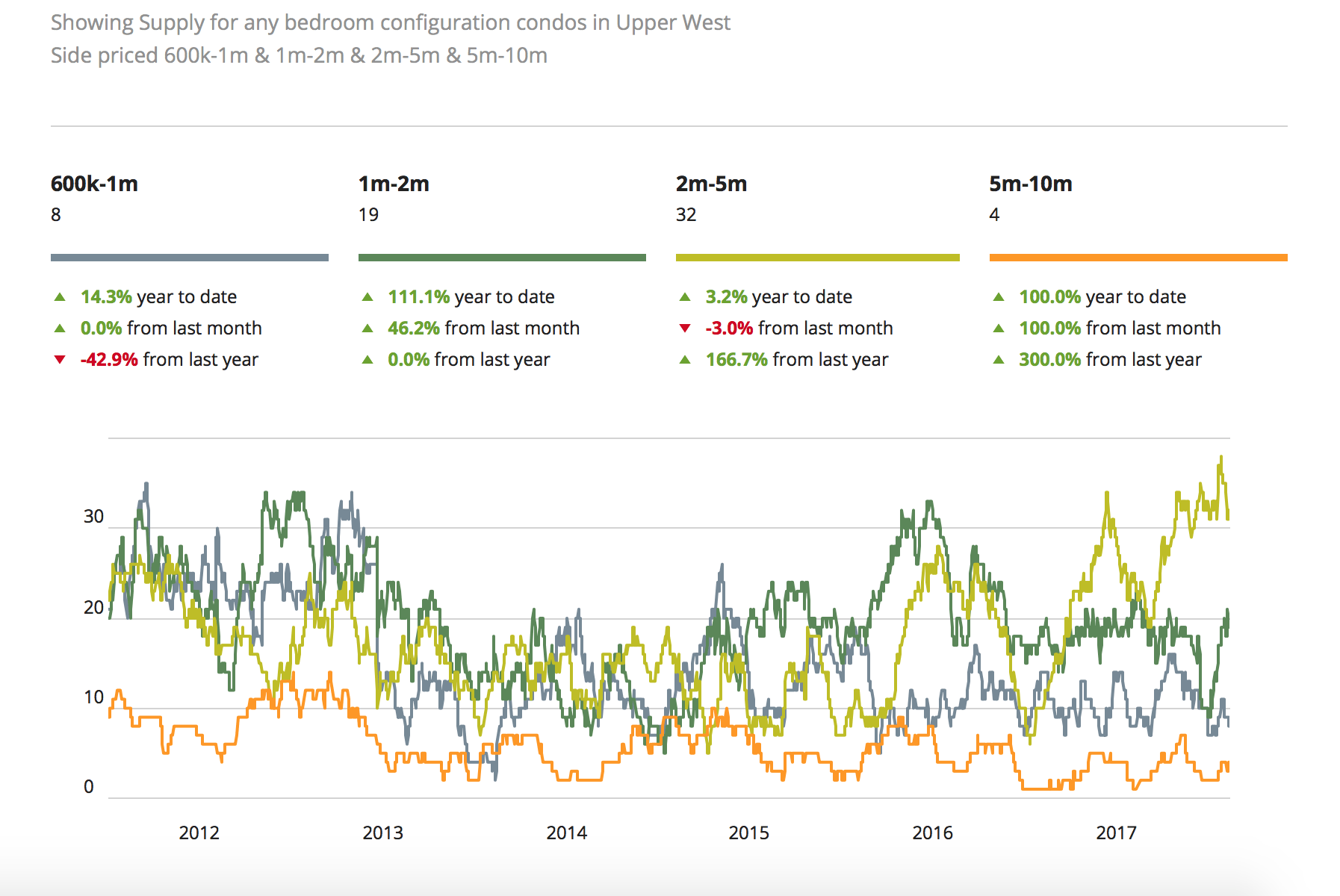

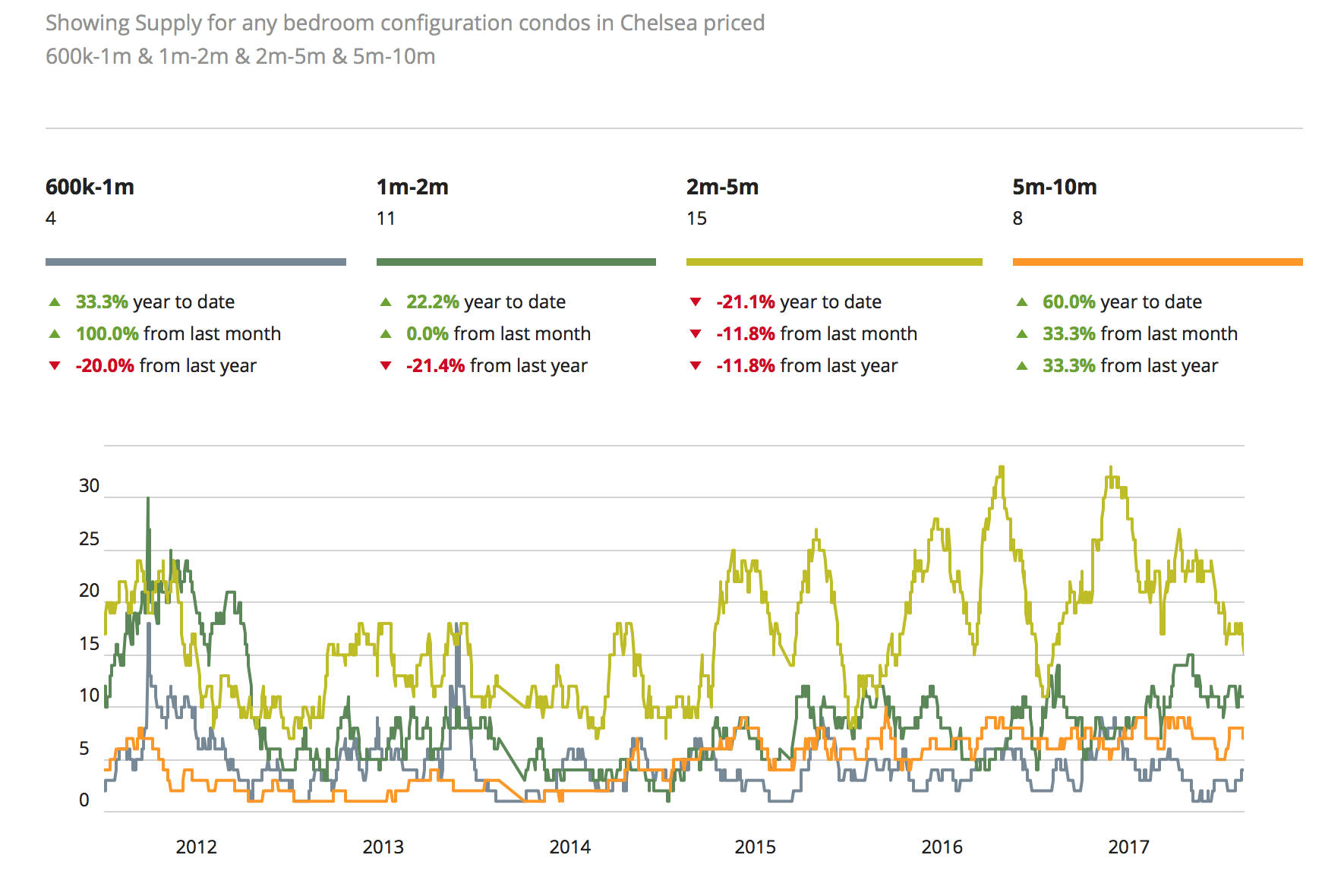

While this Q3 2025 report focuses on Manhattan-wide trends, significant variation exists across neighborhoods. Premium areas including the Upper East Side, Upper West Side, Tribeca, SoHo, and the West Village continue to show particularly strong luxury condo and co-op performance.

Buyers and sellers seeking detailed neighborhood-specific Manhattan real estate analysis should consult with experienced local brokers who can provide granular market insights for specific buildings and streets.

Manhattan Real Estate Market: Key Takeaways

The Manhattan condo and co-op market delivered exceptional Q3 2025 performance:

-

Sales Surge: 3,158 closings (+13.4% YoY) reached highest level in 2+ years

-

Broad-Based Growth: Both condos (+16.6%) and co-ops (+11.0%) posted double-digit gains

-

Price Appreciation: Third consecutive quarter of median and average price increases

-

Luxury Strength: High-end sales up 13.6% while inventory down 16.1%

-

Cash Dominance: 65.3% of all sales and 90% of sales over $3M were cash

-

New Development Boom: 71% sales increase, highest market share in 6+ years

-

Market Velocity: Days on market down, months of supply improving

-

Above-Average Performance: Sales running 4.3% above 10-year norms

About This Manhattan Real Estate Market Report

This comprehensive Manhattan condo and co-op market analysis is based on the Q3 2025 Douglas Elliman Real Estate Market Report, prepared by Miller Samuel Real Estate Appraisers & Consultants. The report analyzes closed sales data for Manhattan condominiums and cooperatives, providing the most accurate picture of current market conditions.

For personalized Manhattan real estate insights, neighborhood-specific analysis, or to discuss buying or selling opportunities in the current market, please contact me directly.

Best Regards,

Anthony

Data Source: Douglas Elliman / Miller Samuel Q3 2025 Manhattan Sales Report

Last Updated: October 2025

Manhattan Real Estate FAQs Q3 2025

What is the median price for a Manhattan condo in Q3 2025? The median Manhattan condo price reached $1,650,000 in Q3 2025, up 2.2% year-over-year.

What is the median price for a Manhattan co-op in Q3 2025? The median Manhattan co-op price was $870,000 in Q3 2025, up 3.6% annually.

How many Manhattan real estate sales closed in Q3 2025? 3,158 Manhattan condos and co-ops closed in Q3 2025, up 13.4% year-over-year.

What percentage of Manhattan real estate sales are cash? 65.3% of all Manhattan sales were cash transactions in Q3 2025, with 90% of sales above $3 million paid in cash.

What is the luxury threshold for Manhattan real estate? The luxury market threshold (top 10% of sales) was $4,000,000 in Q3 2025, with a median luxury price of $5,922,500.

How is the Manhattan new development market performing? Manhattan new development sales surged 71% year-over-year to 578 closings, representing 18.3% of all sales—the highest market share in more than six years.

-2.png?width=500&height=205&name=MIAMI%20HOME%20SEARCH%20(2)-2.png)